The earliest you can receive Social Security is age 62. You should first consider when you want to take your Social Security benefit. Retirement income can - and should - come in multiple forms.

Planning to spend 85% of your current monthly expenses can add a financial cushion for these activities. While some people may feel comfortable on 75% of their current monthly budget, other people may want to spend more on things like travel, dining, hobbies like golf or boating, and charitable giving. This accounts for reduced commuting costs, potentially less debt in retirement, and not setting aside money for retirement savings. The general guideline for determining your expected monthly expenses is about 75% of what your pre-retirement expenses are.

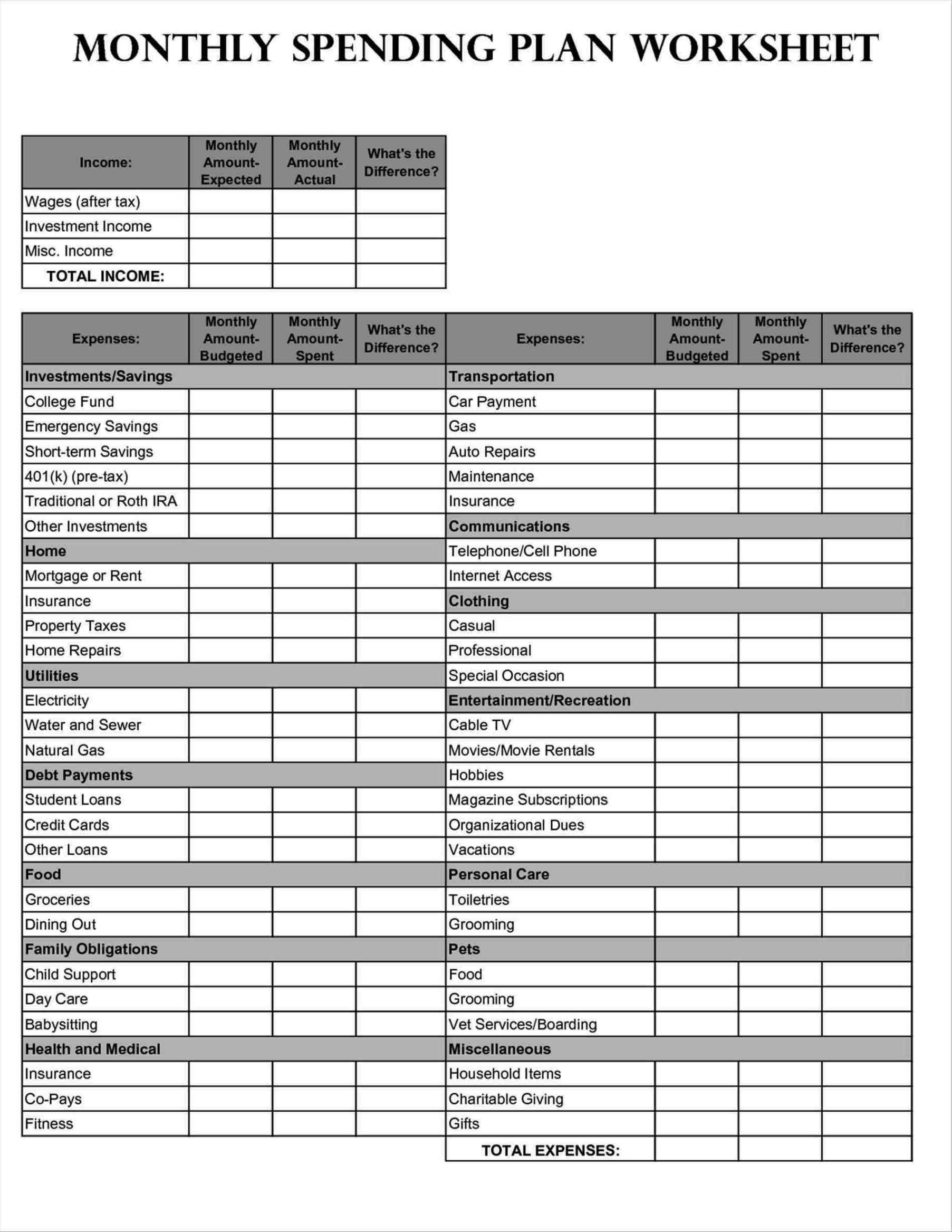

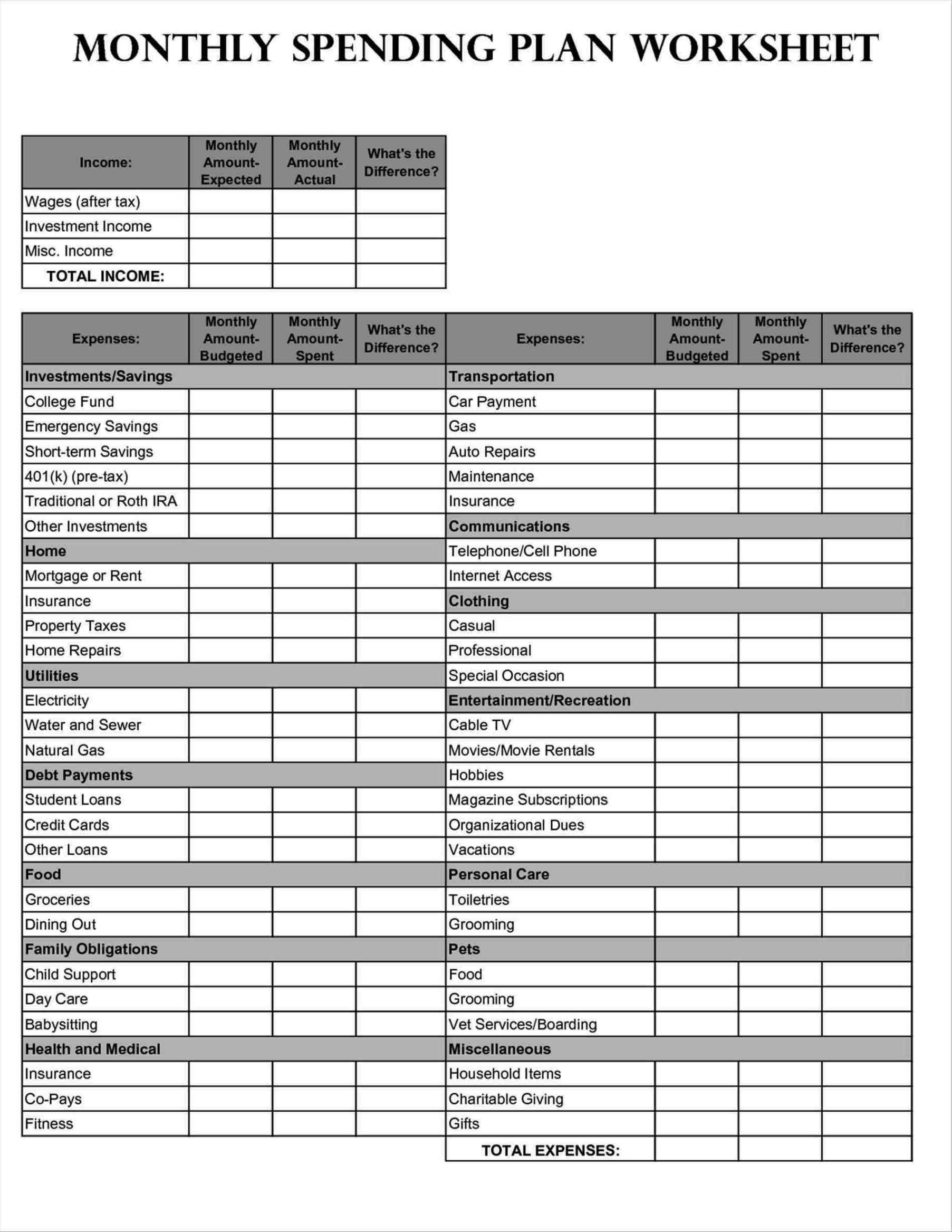

Health insurance-in retirement you’ll no longer receive an employee group rate, so your expense for this may increase. You need to know what you spend each month during your working years in order to estimate your expected expenses during retirement. Calculate Your Monthly Expensesīefore you can determine your monthly expenses in retirement, you need to have a working understanding of your current household budget. To help you make this important decision, here are five actions to take before you retire. What will give you purpose? What experiences do you want to have? You should have more than a vague idea of how you want to spend your time in retirement. You should know where your retirement income streams are coming from, what monthly expenses you’ll have, and how long your savings will last. You should have both short and long-term financial plans. Of course, there are financial considerations going into retirement. While no two finish lines look the same, there are some common requirements that should be met before you retire.

Health insurance-in retirement you’ll no longer receive an employee group rate, so your expense for this may increase. You need to know what you spend each month during your working years in order to estimate your expected expenses during retirement. Calculate Your Monthly Expensesīefore you can determine your monthly expenses in retirement, you need to have a working understanding of your current household budget. To help you make this important decision, here are five actions to take before you retire. What will give you purpose? What experiences do you want to have? You should have more than a vague idea of how you want to spend your time in retirement. You should know where your retirement income streams are coming from, what monthly expenses you’ll have, and how long your savings will last. You should have both short and long-term financial plans. Of course, there are financial considerations going into retirement. While no two finish lines look the same, there are some common requirements that should be met before you retire.

Deciding when to retire is both an emotional and financial decision, and for some, it’s one of the hardest decisions in life. Key considerations for retiring at the right timeįor many people, retirement is the ultimate goal-the end of a marathon.

0 kommentar(er)

0 kommentar(er)